Real Stories, Lessons, and Next Steps

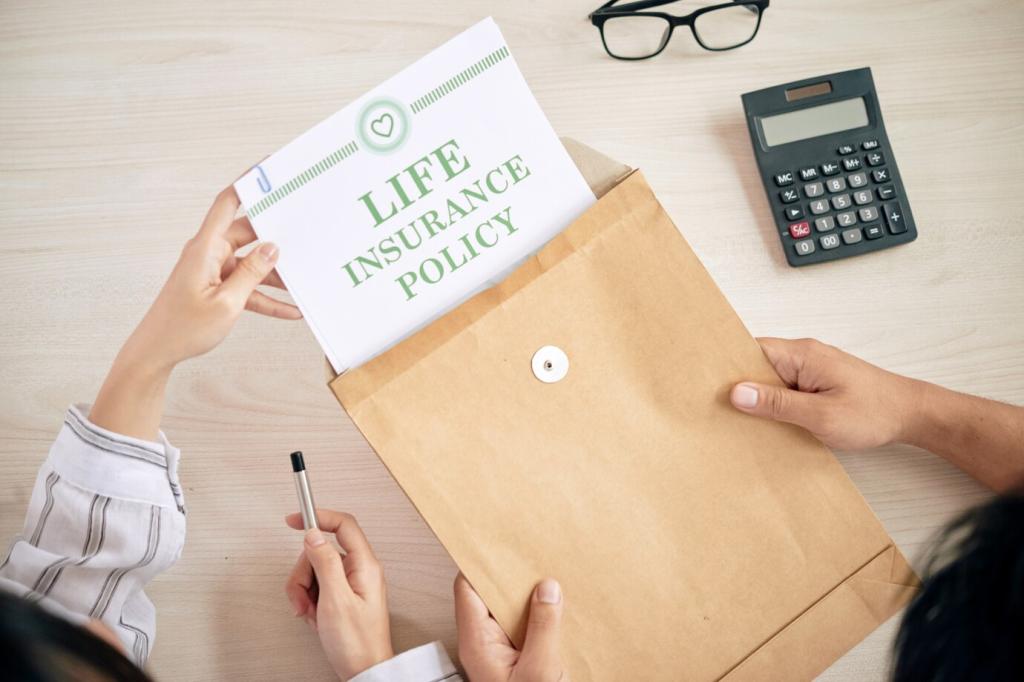

When Linda’s father needed help bathing and dressing, their claim moved quickly because she had assessments, invoices, and a care plan ready. Her policy’s monthly maximum covered four days of aides each week. Subscribe to download the exact checklist she used, and comment if you want a blank template.

Real Stories, Lessons, and Next Steps

Sam needed memory care sooner than expected, using most of his pool. Their shared care rider unlocked Priya’s remaining benefits to extend his stay. The feature cost extra, but it preserved their retirement savings. Share your thoughts below if shared care feels worth it for your situation.